World's Greatest Business Model?

How did two guys with $400K and a Rolodex transform into a trillion-dollar titan?

Well it helps if your business model:

Has massive + free leverage

Attracts and keeps elite talent

Distributes high current cash flow with 20%+ total returns on partners capital

Operates in an industry with unlimited growth opportunities

I’m talking about a world-class investment business.

To be specific: A general partnership (GP), which is the ownership entity of a successful private equity or real estate private equity firm.

Caveat: the word “successful” is doing some heavy lifting in the sentence above. If you can’t deliver great returns, you don’t pass go, you don’t collect $200.

But if you put up consistent numbers, GPs tend to hit escape velocity around Fund 4 or 5 and often build a perpetual cash flow machine.

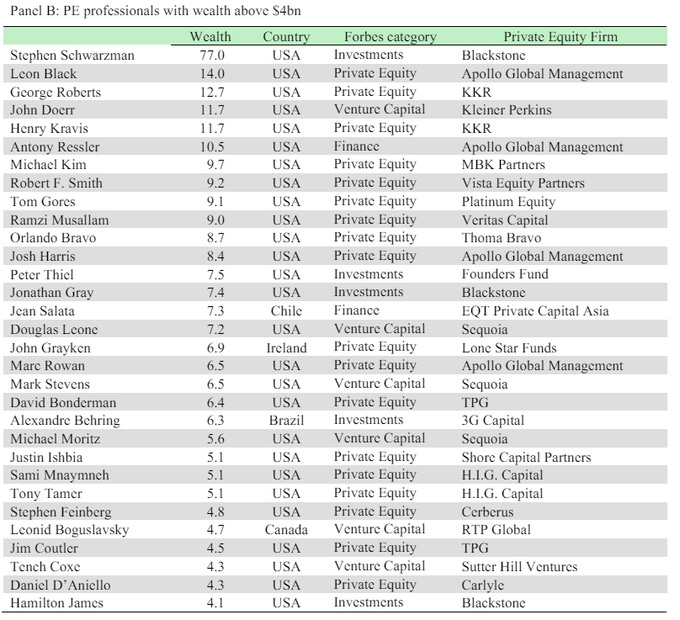

This is why the Forbes Billionaire List is chock-full of fund managers.

Case in point:

Blackstone started with $400K.

They now have $1 trillion in assets under management (“AUM”) and will probably post ~$10 billion in revenue next year with 65% of that stemming from long-term management fees.

That’s without:

building expensive factories or supply chains

selling a tangible product or holding inventory

having to maintain or upgrade software code

The business is just people and brand.

Which is why some GPs earn a staggering 40% return on the partners’ invested capital in the company.1

It’s also probably why they feel confident enough to put these Christmas videos out into the world.

We’ll tick through each of the above five characteristics below. But at a high level, large GP’s print money because of the efficient flywheel embedded in the business model.

If you’re not familiar with the Flywheel concept, here is the most famous business flywheel from Jim Collins’ brief but excellent book on the topic:

Now here is a General Partnership flywheel (from Alix Pasquet of Prime Macaya Capital Management):

This is hilarious, but Mr. Pasquet is only partially kidding.

Higher AUM enables firms to attract and keep investment talent, which is the intellectual property (“IP”) behind every great GP.

So, what makes general partnerships such beautiful businesses?

1. Free Leverage

There’s obviously debt at the individual property or company level and sometimes even a little at the fund level.

But the compelling leverage here is Limited Partner (“LP”) capital. If you think about it, this money is a form of off-balance sheet financing (aka an awesome loan).

And it’s the oil that makes the flywheel turn faster. Without it there isn’t a business so the best investors treat LP capital with the fiduciary respect it deserves.

PE firms also use more subtle forms of leverage like subscription financing and scale economics - as it doesn’t take 10x the staff to go from a $100M to $1B in AUM.

For the best GPs, every marginal dollar in AUM raised is more valuable to the firm than the prior dollar. This is powerful.

Private equity firms typically put up 1-5% to launch a fund. The rest of the money (95%-99%) is non-recourse leverage for the GP.

Hence the sky high returns (often 20%+) on partners’ capital.

It’s good to be a GP.

Thankfully, it’s also lucrative to be an LP of these firms. But if you want the moon, you want GP economics.

2. Magnets for World-Class Talent

Private equity has consistently delivered outsized returns (even in rising rate environments), making senior partners tremendous wealth. Consequently, they can afford A+ talent.

These elite employees drive even higher returns, which increases fundraising, which attracts other killer employees. Hopefully you’re starting to see how this works.

Please don’t make be drag out the flywheel picture again.

3. Massive Call Options on GDP Growth

Heads GP wins, tails GP wins BIG.

The best PE and Real Estate shops drive operational improvements to increase asset value. But, even if they can’t operate their way out of a wet paper bag…they still get another bite of the apple: above average GDP growth or multiple expansion.

For example, a standard roll-up of smaller assets into a large portfolio (a common tactic) attracts a premium multiple. Buy a bunch of small deals at 5x, sell portfolio at 10x.

Or this could be good old fashioned Federal Reserve induced multiple expansion.

Given our likely higher for longer rate world, help from the Fed might not be there this cycle, but it will return.

Regardless, the best GPs seem to always find a way to outperform and capitalize on the massive free call options (the profit promote) embedded in every fund.

And even if they completely whiff on a fund:

They can still collect 10 years of fees on a $1 billion fund, which at $200 million is still a decent chunk of change.

In their defense, they’ve earned it. The top-tier PE firms have delivered outstanding returns to LPs across cycles.

Underlying PE deal returns by vintage year:

But the GP returns are just a tad better.

For example, on an 18% gross IRR for a 10 year fund, the GP probably posted a 39%+ IRR on their 5% co-investment.2

Once again, it’s good to be the GP.

4. Giant Runway for Growth

Will investors ever get tired of making passive money? Will LPs every say, “you know what, we’re getting bored with all this money you keep sending us”.

Probably not.

There will always be new funds to raise

There will always be new investors hungry for non-correlated returns

There will always be more companies and properties to buy and loans to be made

And these funds are not just replacing each other every 10 years. Most large PE firms are now focused on growing permanent capital.

Consequently, GPs - with their lucrative and contractual management fees - are starting to look a lot like enterprise software (without the threat of AI disruption).

Great businesses are built by going ridiculously far in maximizing 1-2 things.

At the end of the day a GP is a simple business:

Deliver top-tier returns to LPs

Drive AUM growth

Conclusion

To be honest Google Adwords / Online Advertising is probably the greatest business model every created (assuming AI doesn’t kill search).

But the general partnership, which has near perfect market fit for institutional LPs, is definitely on the short list.

I can’t think of many business models with such powerful, structural advantages as a well-run General Partnership.

That’s why we have such strong conviction in GP investing (GP Stakes).

It’s an opportunity to sit on the same side of the table as world-class GPs and enjoy their economics.

Therefore, we don’t need to question their motives or alignment with our capital.

It’s one and the same.

And best of all, we don’t have to wear Patagonia vests or make goofy corporate Christmas videos.

Best,

Brad Johnson

Blackstone’s Return on Partners Capital: Value Line, 2024

This estimated return includes net management fees (at a 60% operating profit).

The information and statistical data contained herein have been obtained from sources that we believe to be reliable but in no way are warranted by us as to accuracy or completeness. The information discussed herein is for informational purposes only, and is not intended to provide, and should not be relied on, for investment, tax, legal or accounting advice.