Investing Lessons From Baseball Cards

What 35 years of stubbornly keeping old boxes of cards teaches you about investing

I fell in love with investing by collecting baseball cards when I was 10.

My favorite day of the month was when Beckett Baseball Magazine - which listed card values - arrived in the mail.

I’d race to my room and go through my collection one by one, updating a makeshift ledger with the new values (even including 5 cent increases)…like a psychopath.

One month my Mark McGwire rookie card “skyrocketed” 5 bucks and it blew my mind.

I did nothing, time passed and somehow I was a little richer.

I’ve held on to that thought ever since.

Of course, this wasn’t actually investing. This was speculating.

A cheap piece of cardboard that smells like stale gum doesn’t have intrinsic value. It doesn’t generate reliable cash flow.

Buying baseball cards is the same thing as collecting beanie babies, art, or bitcoin: they are only worth what someone else will pay for them. Speculative assets are subject to “animal spirits” and lead to boom and bust cycles.

Sometimes they make people lose their minds.

Yet there are still some valuable investing lessons to be gleaned from card collecting.

Investing Lessons

I’m currently trying to brainwash my 10 year old son by getting him into card collecting. Somebody has to take over Evergreen Capital someday (A dad can dream).

We are going through old boxes of cards and updating values just like I did 3+ decades ago. He is loving it.

I highly recommend doing this with your son / daughter or grandkids.

Here are the investing lessons I’m hoping sink in:

Lesson 1: Endowment Effect.

My son has found a bunch of the below cards. Ten year old Brad thought these would make him rich someday.

That kid didn’t know squat about investing.

I had to do a bunch other stuff to make money. The above cards are collectively only worth ~$700 some 35 years later. Or it might be $500, or perhaps $300. I am probably overvaluing them. Why? Because I own them.

This is called the “Endowment Effect.”

It’s the propensity to overvalue things you own vs. the market. The market doesn’t care that I’ve shlepped these cards around for 30+ years. The market isn’t sentimental.

Regardless, these cards probably made a solid single digit return compounded over ~3 decades.

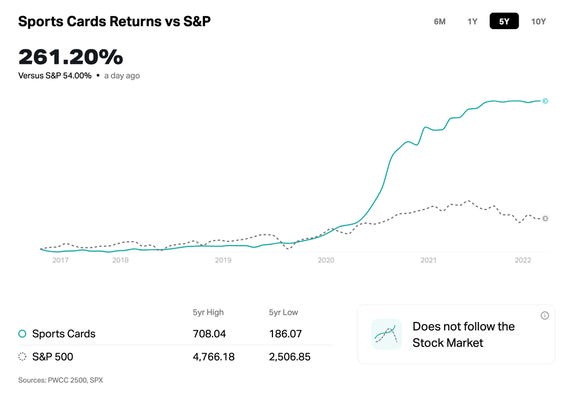

BUT….it took a pandemic to reignite interest in cards. Nostalgic middle-aged men across the globe were either so bored (or desperate for home office space) that they busted out the old boxes of cards.

Lesson 2: Assets detached from cash flow are highly dependent on momentum and supply.

This is just as true for baseball cards as it is for stocks. Profitless tech companies with horrible unit economics tend to soar not because of thoughtful valuation, but because:

They have a good story that causes investor “FOMO”

There’s an oversupply of money (fiscal or monetary stimulus)

Lesson 3: Pick-And-Shovel Businesses = Great Investments

An oversupply of the product also kills value. It’s akin to companies that issue too many shares (dilutes equity / existing shareholders).

This is why 1980s was the worst decade ever to start collecting cards. Baseball cards were hot so new companies flooded the market with new supply. This makes 99% of cards from that decade worthless.

To artificially restrict supply, grading companies (they grade the condition of the card) have stepped in. For the most part, only the absolutely pristine cards (sharp corners, perfect printing, etc.) have value today. Of course, not touching the cards takes a lot of fun out of the process for kids.

This gave nerds a big advantage in the market.

So, in order to sell a baseball card for full value today, it must be graded by a trusted 3rd party. This is so buyers have faith a card is authentic and in mint condition.

This grading costs $20 to $30 per card. This ads up when you want to grade hundreds of cards. Oh, and the two grading companies (Beckett and PSA) also help set the market prices.

Now this is a beautiful business model.

It’s similar to bond rating agencies. For example: Moody’s ($MCO), is another highly profitable picks-and-shovels business in a duopoly with huge returns on invested capital. Large debt buyers and sellers can’t transact without their stamp of approval, which costs Moody’s next to nothing to produce.

It pays to provide the infrastructure for the party.

Lesson 4: Investing Requires Dedicated Patience

With an assist from mom during college + grad school, I hauled my boxes of cards from apartment to apartment and then from home to home.

Had I just thrown them away when they were worth nickels…you wouldn’t have had to suffer through this investing metaphor.

True compounding takes at least 10 years - and more often decades - to play out.

Lesson 5: Selling Discipline

My son wants to sell every. single. card. Like yesterday.

Reason being, I told him he’ll get a commission on whenever he sells a card on E-bay / or at a trade show this spring.

He’s probably right though.

The post-covid air is already coming out of this ballon, just like every other speculative asset in 2022.

This is difficult, because to achieve outlier results, you have to hold assets through uncomfortable periods of overvaluation. Yet, when things get silly, I still prefer to sell outright or “trim” such holdings.

But I still want to keep the best of the bunch.

Lesson 6: Quality Wins

Power laws are everywhere in investing. Over long hold periods, the best of the best deliver a disproportionate amount of the returns.

You only have to compound a couple of percentage points higher than the market over a long time to achieve unreal outcomes. It only takes a few stellar investments.

Turns out this is true for baseball (and basketball cards). All Hall of Fame players appreciated over time but most only delivered average returns.

But - if given enough time - the LEGENDS outperformed by orders of magnitude.

A mint condition Michael Jordan 1986 Fleer rookie card sold for $750K at peak craziness in 2021. One recently went for ~$120K. Poor condition (low rating) even sell for a few thousand each.

So…while few people will care about these things in 50 years - I’m keeping all the Ken Griffeys, Barry Bonds and Michael Jordans.

Lesson 7: Quality Hiding in Plain Sight

Clearly card collectors would have been far better off accumulating a portfolio of the few legendary players vs. the hundreds of pretty good / great players.

And you didn’t need to get lucky or guess correctly to find these players. Jordan was pretty amazing his first NBA season. Same goes for Lebron. You just had to pay market price and hold on.

This holds true with some of the greatest stock investments. Everyone knows these businesses are great so they almost never sell for a price that looks or feels cheap. Yet at the same time, almost everyone underestimates the true value of greatness. Once again small performance gains lead to unreal dollar amounts over long time periods.

But too many of us went hunting and hoping for the next Jordan at discount prices.

We all want a deal.

Of course, this is part of the fun. I do it too and it can certainly pay off, but I’ve learned to make is small part of my investing process.

So speculate around the edges, but make sure your core investments have undeniable quality. Or just buy a bunch and put them a box for 35 years.

Brad

Evergreen Capital

Whenever you're ready, there are few ways Evergreen can help:

1. Higher earners or entrepreneurs: We provide custom investment management and tax planning. Reply to this email to learn more.

2. Accredited investors seeking high dividends, join our Income Fund.

3. Wealth builders seeking growth + accountability.