Non-Accredited Investment Option

Compounding Dividend Strategy

Young professionals are provided outdated advice & limited investment options for building wealth.

While advanced investment strategies and guidance are only available to already wealthy investors, pricing out the vast majority of Americans.

We think this is unfair.

Evergreen wants to educate, mentor, & help you & your money reach the level of your ambitions.

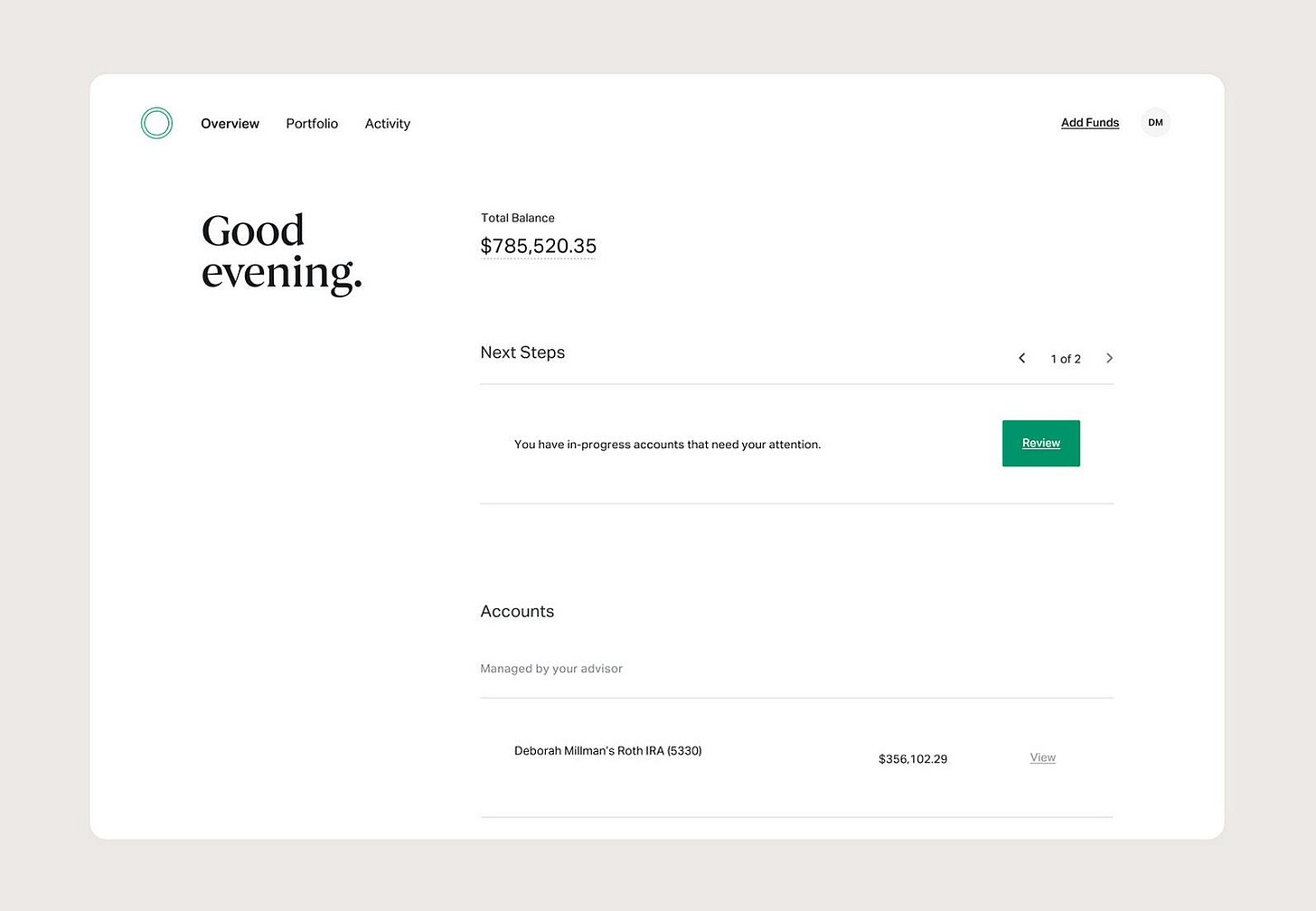

Your Client Dashboard

With Evergreen you’ll immediately own a liquid and income producing real estate portfolio, which we consistently adjust to put more money into our most undervalued holdings. We believe this is superior to a basic buy-and-hold approach.

Our core strategy is simple, but not easy:

We analyze and buy world-class real estate assets trading at a discount to their private market values.

Why a Dividend Growth Strategy?

We believe this account can eventually fund your lifestyle via regular income that requires nothing from you.

This separates your income from your time while letting your investment principal keep growing for you & your family.

Compounding income over the long-term without sacrificing growth is the north star for this strategy and will provide the foundation for your investment program with Evergreen.

This strategy generates regular dividends, which will be automatically reinvested to buy you even more dividend income. To add gas to this fire, we suspect most clients will add incremental capital to this strategy each month or year via our auto-investment plan.

The long-term goal is once your account reaches critical mass, you’ll turn off dividend reinvestment and start collecting payments that total an amount (each year) that’s substantially higher than what you initially invested.

Dividend growth investing is a great baseline wealth building strategy because it:

will help you see the progress of rising income and stay the course by focusing on what matters: cash flow growth vs. arbitrary stock prices (short term volatility).

has the long-term potential to cover your monthly expenses, which enables you to focus on higher pursuits.

Therefore, we don’t focus on what the market says our cash flow is worth each year. We don’t care about short term performance or volatility - we just want to acquire more ownership shares of great + undervalued assets and let the income grow exponentially.

The appreciation (stock prices) eventually follows the cash flow.

Client Portfolio View

What Are The Specifics?

You’ll be invested in a Real Dividend Growth portfolio which is a long-only (no leverage or options) public real estate strategy. This will hold many of the same REITs and real estate related businesses as our private Income Fund for accredited investors, which has outperformed on both income (~2.6X) and total returns since inception.

The objective with this strategy is to build long-term dividend growth and realize double-digit annualized returns over many years. Your dividend yield will fluctuate, however short term yield is not what we’re optimizing for. This strategy is for wealth builders. We want to solve for maximum dividend payments for your future. We do that by focusing on cash flow growth, not yield today.

Once again, our goal for your account is to methodically acquire enough shares to pay you - and someday your children - back EVERY year, a multiple of what you invest.

You’ll have direct access to your own separate account. This is NOT a commingled fund. Your account and its diversified holdings are held in an insured custodial account you own. We can only manage the investments within your account.

Your account is protected by SIPC, insured up to $500,000.

You’ll be a client of Evergreen and we must legally act in your best interest.

Low fees: 1% asset management fee only. No performance fees.

Full alignment - the partners of Evergreen are co-invested with you.

Full transparency - you can log into your account and see every holding, transaction and dividend reinvestment in real time.

You can close your account and withdraw funds anytime if you change your mind.

Investment Minimum

The minimum is only $10,000 to start an account with Evergreen.

We’re playing the long game here.

So whether you have $10K or $500K to invest - if you’re committed to long-term investing / real wealth creation we’d like to work for you.

We have the exact same goals for your account as you do. We want your account to grow substantially. We are incentivized to help you build lasting wealth.

But obviously one $10K investment is not going to get you where you need to go. Therefore, for sub $50K accounts we recommend setting up smaller monthly auto-investments in your account. You can change this auto-invest setting within your account at any time.

Mobile Account Access

Bottom Line:

Evergreen can now help both unaccredited and accredited investors.

You become a client, we become your fiduciary / accountability partner in your growth and build a growing dividend income stream for you, with zero tenant hassles (unlike private real estate).

If that sounds good, click below. We just need your basic info to get your account started.

Our onboarding process is fast and simple. After getting your basic info (form button above) we will set up your account and send you an email invitation to create a login. You can have your account up, funded and running in one day.

The team at Evergreen is looking forward to working for you!

Thank you,

Evergreen Capital

FAQ:

How does liquidity work? Can I withdrawal funds if needed?

A: Absolutely, these are fully liquid investments that are publicly traded, held in a custodial account insured up to $500,000 under your direct ownership. We are managing the investments for you. That being said, this should be viewed as a long-term investment. That’s core to our company and why we exist. This is also why we focus on cash flow, it’s easier to stay invested when you own cash producing assets.

What if I am more risk averse?

A: All investing requires risk taking. If you cannot hold through drawdowns, public markets are probably not appropriate for you. We are buying ownership is real assets that generate cash flow regardless of daily stock price movement.

If you have a long investment horizon, negative stock years are typically a positive as you’ll be reinvesting regularly and buying shares “on sale”. However, for larger accounts we can make custom changes such as adding bonds to reduce volatility.

What will you do with my money?

A: It will be invested in a diversified portfolio of cash producing assets, namely Real Estate Investments Trusts (REITs) and other real estate related businesses that are publicly traded.

We manage these holdings closely and actively adjust ownership percentages based on valuation.

Is now a good time to invest in public real estate?

A: Short answer: Yes (as of today) most public real estate is priced at a discount to private real estate, which has historically lead to compelling 3 year returns. However, we don’t have a clue what will happen in markets over the short term. Nobody does.

We believe the specific date of your initial investment (market timing) is unlikely to make a dramatic difference given the long-term focus + dividend reinvestment component of this strategy.

The goal is to methodically accumulate shares of high quality assets that will eventually help fund your lifestyle via large dividend checks when you decide to pull back from your career and stop reinvesting dividends.

Through dividend reinvesting - and ideally auto-deposits of additional funds - we want to be buying undervalued real estate in all cycles (called “dollar cost averaging”), regardless of what the stock market is doing in any given year. The goal is to accumulate a lot of ownership / shares, which has the potential to deliver exponential dividend payments over time.