From Boil to Simmer?

With yesterday’s 8.5% CPI print, we might be past peak inflation.

We called high inflation when the Fed claimed it was transitory and predicted CPI would start to turn this summer. These weren’t bold macro predictions on the distant and unknowable future. They were educated guesses based on trended data.

Long term forecasts are a fools errand, but taking action on short-term predictions - using real-time trends - can be extremely useful.

This is especially true with something as dangerous as inflation, which is self-fulfilling, destroys wealth and destabilizes societies at the extreme.

In other words, when driving 100 miles an hour it’s best to react to what’s right front of your face vs. guessing what’s 50 miles down the road.

Unfortunately, our politicians had the “Mission Accomplished”, vibes going yesterday on the inflation news. I don’t think investors can afford to be this casual.

Now What?

Did the Fed tame the beast? Will inflation quickly decline from here to the goldilocks 2-3% we’d all love to have back? Don’t bet the farm, but I doubt it.

The labor market is still surprisingly strong (albeit with signs of softening) and we’ve just started on-shoring supply chains, which isn’t going to be cheap.

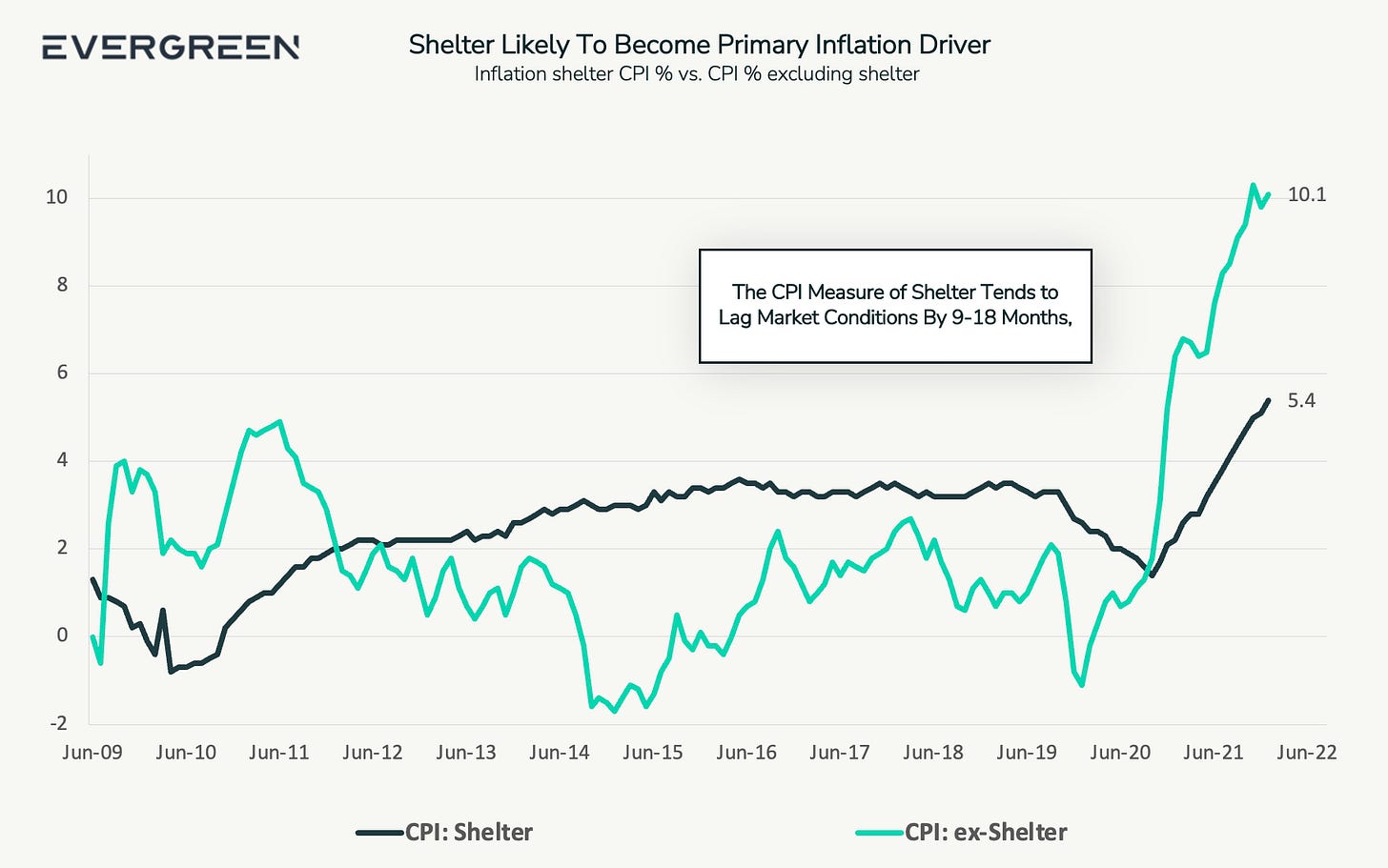

Furthermore, despite the recent softness in the housing market, shelter driven inflation is going to be annoying sticky on CPI readings over the next year.

The CPI shelter component is broken. For some reason home price and rent increases are on 12-18 month lag! 1

In other words, despite recent double digit increases in housing & rents, the shelter CPI component has actually been an anchor on CPI readings this year.

This is the reverse from 2010-2020, where rents were one of the few components preventing deflation as inflation struggled to stay above 2%.

But now shelter, which accounts for ~40% of CPI readings, is starting to tick up.

July CPI (8.5%) components and trend:

Food: 1.5% (falling)

Energy: 2.4% (falling)

Used cars: 0.2% (falling)

Commodities: 1.2% (falling)

Services: 1.4% (rising)

Shelter: 1.8% (rising)

Hopefully, these trends continue and inflation readings will taper. But given shelter’s delayed impact, we have a long way to the Fed’s desired 2%.

What to Do

If above average inflation (4-5%) persists, the cost of capital is going to be structurally higher for longer. That means lower multiples for subpar assets.

Investors have two solid options to combat sustained inflationary periods:

Up your allocation to real assets

And / or focus on companies with pricing power

Expenses are skyrocketing. If an asset or business fails to pass through those costs to customers, the market is going to be especially unkind for the foreseeable future.

Many businesses have actually gotten a free pass on inflation's impact to earnings thus far. Reason being: Americans are flush with cash.2

Companies quickly increased pricing this year without much pushback. That’s not sustainable even if inflation stays elevated. The consumer won’t be drunk on stimulus cash and excess savings forever. Soon enough consumers will start prioritizing their spending on highest value products and services.

A roof over their head is high on that list.

Another $1 increase for a massive Chipotle burrito they might turn into two meals? Sure, charge away.

But an extra $10 for DoorDash delivery?!? I’m guessing consumers can go back to walking if things get tight.

Stubborn inflation means asset quality, smart sector selection and operational excellence just became a lot more valuable. The rising tide that lifted both battleships and dinghies alike is gone.

Brad Johnson

https://www.dallasfed.org/research/economics/2021/0824

Source: Blackstone Investment Strategy, Bureau of Economic Analysis, Federal Reserve, Bloomberg and Haver Analytics.