Follow The Flows

Sometimes it pays to lead, sometimes you just need to feed the beast.

A tried and true investment strategy is to find what private equity (“PE”) wants and just sell it to them. Hopefully at a silly price.

Feeding PE could mean developing projects within their favorite asset class, aggregating a portfolio of smaller deals for a premium (portfolio arbitrage) or simply investing in public REITs within their target sectors.

There are a lot of hungry hungry hippos out there:

Source: Company filings, Green Street

Blackstone, Starwood, Oaktree, etc. all have large non-traded REIT funds that are raking in unprecedented levels of cash.

Why the tidal wave of inflows? Core real estate is quickly becoming a bond proxy. Yes, interest rates have risen this year, but it’s hard to get excited about 2% income returns, which are -6% on a real basis this year.

Low leveraged, class A (“core”) real estate has consistently beat bond yields with the added benefit of capital appreciation. Therefore, investors of all stripes are rotating (aka dumping) their fixed income holdings into real estate at a blistering pace.

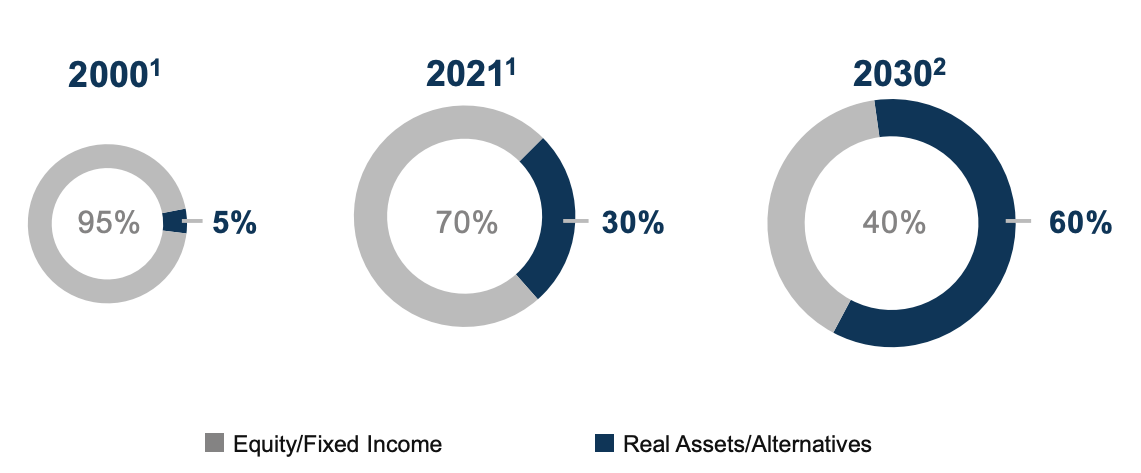

The mega PE firms and pension consultants believe this trend is accelerating, resulting in drastically different portfolio allocations by 2030:

Source: Willis Towers1 & Brookfield2

Real Estate M&A Bonanza

Blackstone has been on a M&A tear. Over the last couple years they purchased Extended Stay (hotels), Simply Self Storage, Resource REIT (apartments), WPT Industrial, Great Wolf Resorts, QTS Realty Trust (data centers) and Preferred Apartment Communities.

I get shell shock thinking of the all nighters the analysts / associates must be pulling over there. And it’s probably not going to stop. I suspect they’ll announce plenty more take private deals this year.

Reason being - a number of public property sectors are trading at a discount relative to their private values. It’s so much more efficient for a mega PE firm to scoop up a large portfolio in one transaction than piece together a portfolio.

Blackstone shops like Dad at CostCo: go bulk or go home.

By the time they could assemble a portfolio via individual transactions large enough to move their massive AUM needle, they might have missed the market.

The size of their funds forced them into this game. They are no longer optimizing for total return, they have become thematic investors looking to press their scale advantage by getting ahead of clear trends.

Conclusion

The massive inflows into private real estate and take private REIT deals are unlikely to stop this year. This has a profound effect on real estate markets and could act as a ballast on private valuations - at least over the short term.

Brad Johnson

Willis Towers Watson Global Pension Assets Study, 2020

Brookfield estimate