The CIO Brief: You Just Never Know

Should happen never means will happen.

I can already hear my kids saying, “Um….thanks, Dad.”

But internalizing this obvious statement is critical to investing and life.

Why? Because there are a ton of downstream lessons that flow from this simple truth:

The deal isn’t done until the wire hits your bank account.

Nothing is a sure bet; there are no guarantees.

Never quit early - fight and claw until the end.

Warning: Sports Analogy

I love the Ryder Cup.

If you’re not a golfer, stay with me for a bit.

Yes, it’s just getting a stupid little ball in a stupid little hole. I admit, most tournaments outside of the majors are boring. Want a great Sunday nap? Turn on the golf and melt into your couch to the soothing sounds of Jim Nantz.

And this is coming from a huge golf fan.

But slap a Team USA logo on it, and I am all-in. Watching guys team up and play for their country just hits different. It turns nerdy, robotic golfers into Captain America.

If you didn’t watch the Ryder Cup, here’s the gist:

America was supposed to win. The US had seven of the top ten golfers in the world, including number one.

They should have won by a lot. They did not.

They were flat out embarrassed the first two days.

I usually only watch Day 3, so I almost skipped it. Why bother? Why suffer when the US “will” lose by a landslide?

But something crazy happened.

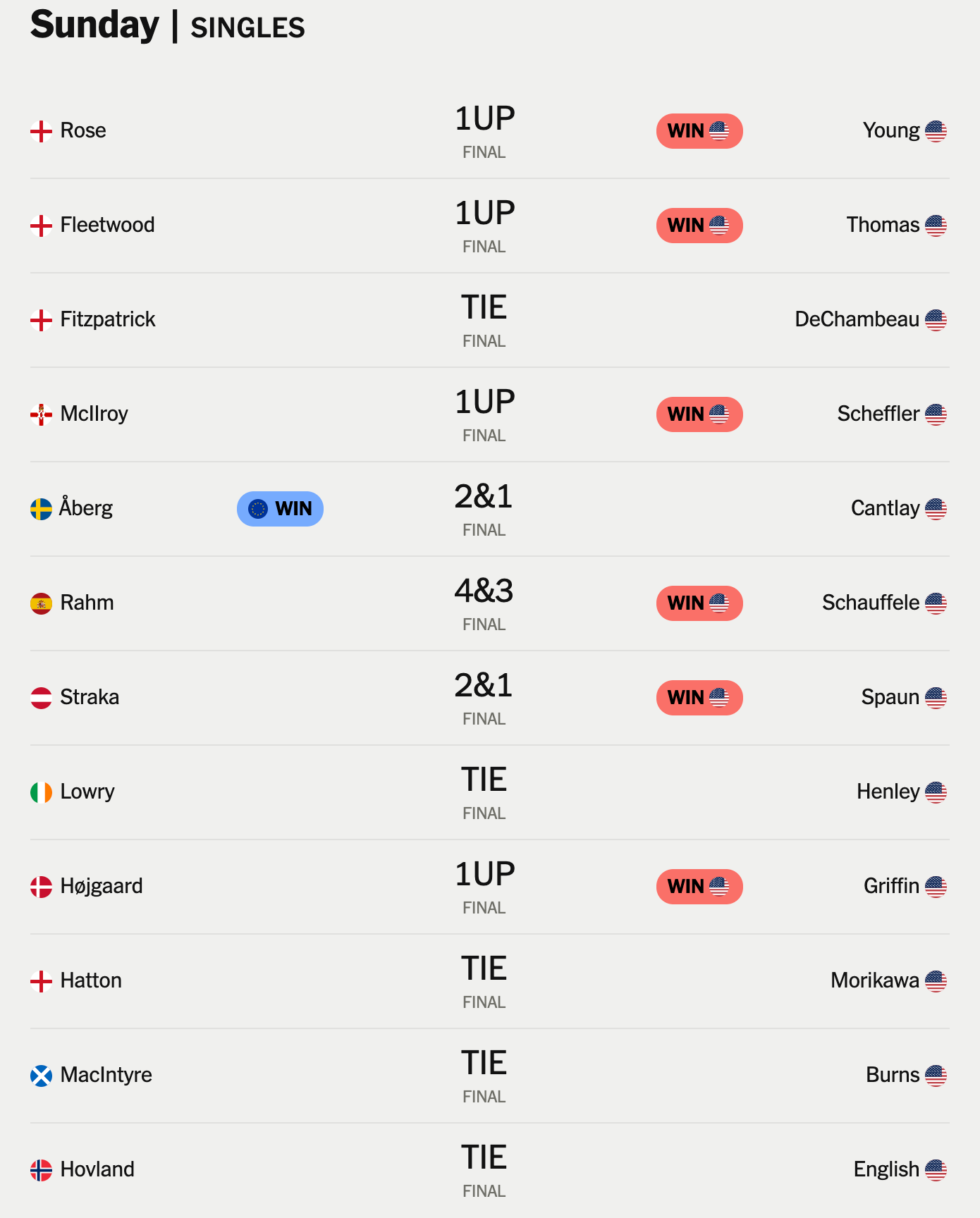

The US put together the most impressive final day in Ryder Cup history. They nearly ran the table on Sunday’s 12 singles matches.

They were literally a couple inches from the biggest comeback in the history of sports.

My likely Sunday nap turned into the most fun I’ve had watching sports, probably ever.

Grown men were giddy watching this thing.

I know, it’s just golf, but man was it fun.

Of course, my point would be a lot cooler if they actual won. But whatever, I was moved watching our team fight like a cornered raccoon despite impossible odds.

You just never know. Crazy things happen all the time.

So keep showing up.

Because the ability to persist in the face of setbacks, unexpected events, bad news and long odds - to pursue your purpose despite lousy conditions - seems to predict success.

Yes, they lost, but heads were held sky high. Nothing left on the table.

That’s how you lose Son.

(and Daughter if you're still actually reading this).

Evergreen Companies?

The Mag 7 should remain dominant and continue to print money. At least for the foreseeable future.

That certainly seems probable. Of course a lot of people felt that way about the elite companies of prior eras (The Nifty 50, The Four Horseman, etc.).

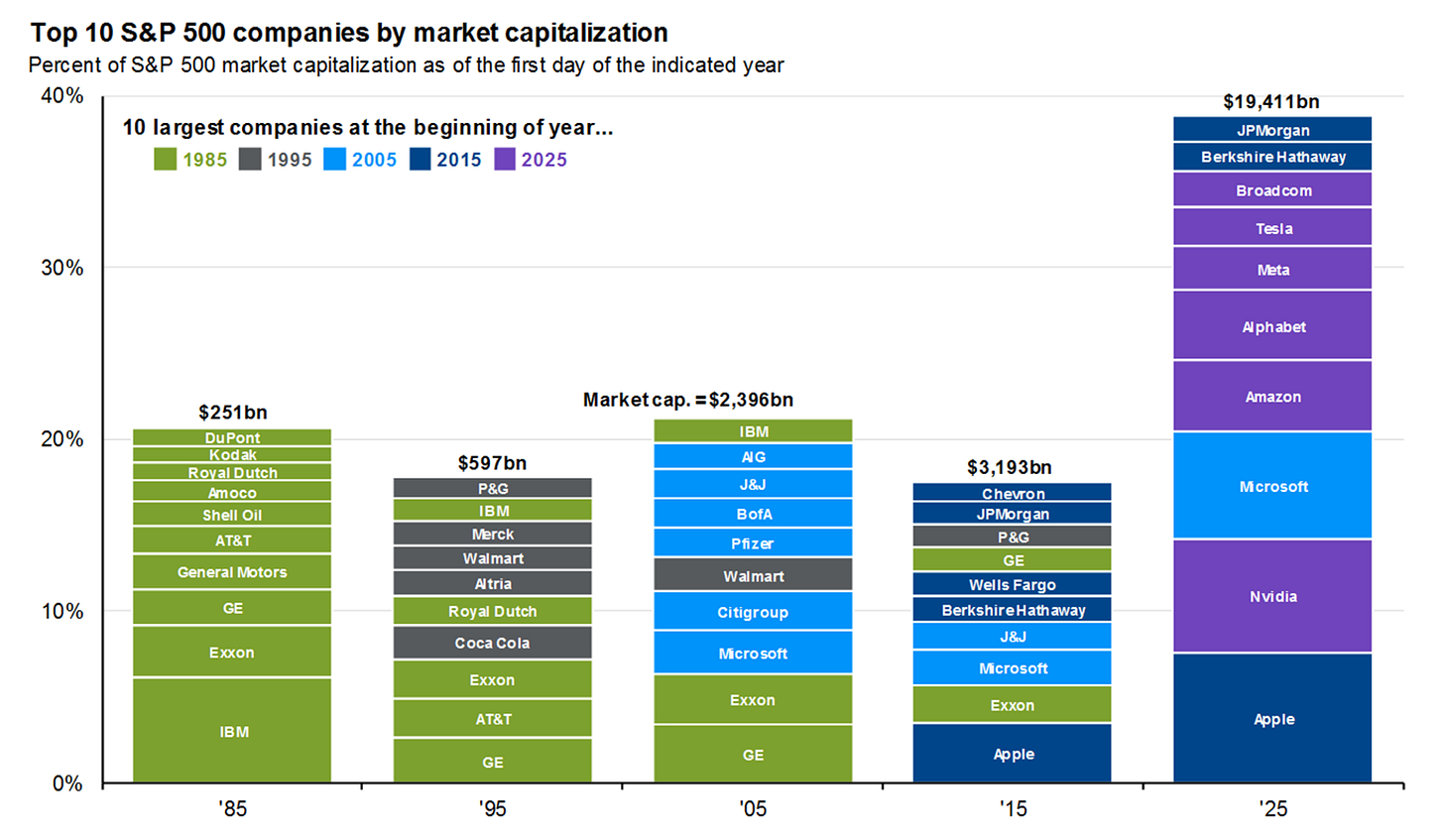

Yet precisely zero of the top companies of 1985 and 1995 are in today’s top 10 today.

And only one from 2005 (Microsoft) and four from 2015 are on today’s list.

And yet, its really hard to image these firms being overtaken or disrupted. History suggests they will.

Then again, “history suggests” is just a fancy way of saying “should”.

So while Evergreen has an opinion on the market, we’re not going to pretend it’s correct.

And thankfully, we don’t have to. We can take whatever may come.

That’s what asset diversification (real estate, private equity, debt etc.) is for.

Off the Trail

Watching Apple lose its innovation edge shows how hard it is to stay atop the mountain.

Also, how great is this plaid shirt guy?

Of course, I’m biased. I basically have a closet full of the same navy dress shirt and the same navy golf shirt. Just a sea of sameness.

I should go shopping, but…I probably won’t.

Best,

Brad Johnson