The CIO Brief: Worry Is Priced In

Your Guess Is as Good as Jamie Dimon’s

“I am an old man and have known a great many troubles, but most of them never happened.”

Any man who has lain awake with his mind racing at 2:00 a.m. knows this feeling.

It’s an unbelievable time to be alive. Life is very good for most of us, which makes it easy to start looking for storm clouds.

Case in point: according to JPMorgan’s Jamie Dimon, the economy is wobbling and could be heading toward a recession.

But it feels like I’ve seen this same headline from Mr. Dimon every quarter for the past decade. Signs of weakness are always present, but even at his lofty perch (with incredible data on the consumer), it’s still nearly impossible to make consistently accurate macro calls.

In other words, yes - there are warning signs. But Recession? Who knows, his educated guess is as good as yours.

Famous investor Bill Miller put it best when asked what worries him about the market:

“The answer is nothing, because everyone else in the market seems to spend an inordinate amount of time worrying. And so all of the relevant worries seem to be covered. My worries won’t have any impact except to distract from something much more useful, which is trying to make good long-term investment decisions.”

Now, a little paranoia isn’t the worst thing in the world - it was pretty useful during the Ice Age. Without it, we were saber-toothed tiger snacks.

But constant worry is not productive.

Thankfully, I don’t spend time worrying about markets for myself or our clients. That might be my Nordic genes. Or more likely, our long-term, highly diversified approach to investing.

The S&P 500 is just one piece of the pie. If it tanks 30% tomorrow - it will get my attention but not my panic.

Yet, I am a far cry from worry free.

If you’re an entrepreneur and/or a parent - worry just comes with the territory.

But, once again, it’s not super productive.

On the rare occasions when my wife or I find ourselves worrying a little too much (about the kids, or anything else), I try to remember that scene in Bridge of Spies, when Tom Hanks asks his client:

Evergreen Signals

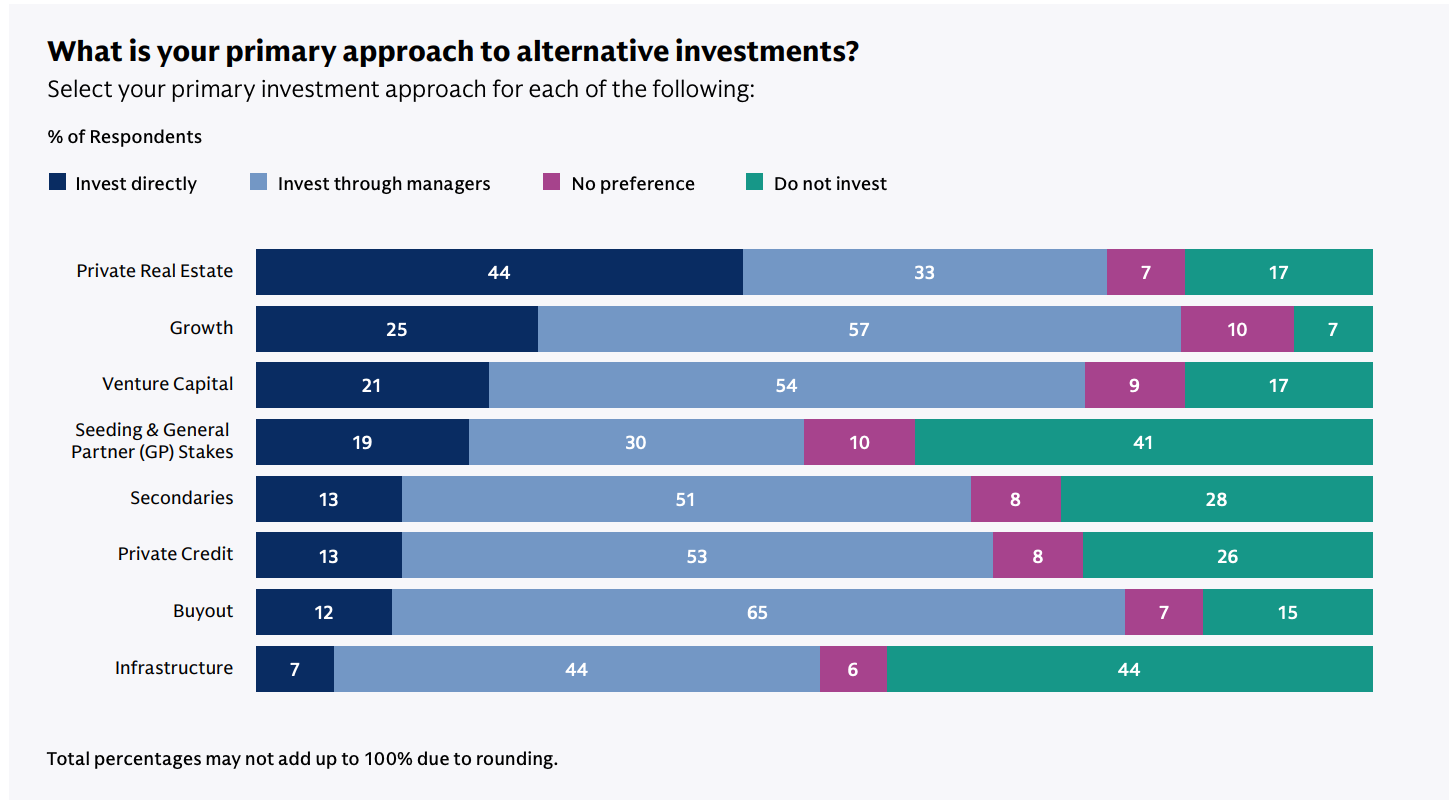

The following is from Goldman Sachs’ yearly Family Office Insights Report. They interview ~250 Family Offices on various investment and allocation topics.

The below is one of my favorite questions as it shows the relative comfort of family offices investing in various asset classes.

The amount of family offices that invest directly into growth and venture capital deals (21-25%) is pretty surprising to me.

I believe most are quite bad at venture investing (aka they are lighting money on fire) and are mostly just doing it for fun.

This percentage is likely to decrease the next few years as a ton of the 2019-2022 vintage deals will lose money / underperform.

On the opposite side, I’m surprised 26-30% of Family Offices are not investing in Private Credit (debt) or Secondaries. Given the lower risk return profile / higher cash flow I expect these percentages to increase this cycle.

Out of The Woods:

This one got me.

My desk is spotless, but my browser is…not.

If you love research, this is a common problem. I’ve never been that bad, but 5 open tabs is too distracting as far as I’m concerned.

Thankfully, AI has pretty much solved this for me. If you still struggle with tab management, I strongly suggest replacing chrome / safari searches with ChatGPT or Gemini.

That or just shut the screen off more often and get outside, you’ll probably worry less.

Brad Johnson

Managing Partner & CIO