The CIO Brief: Free Stuff Ain’t Free

“There are only two places where socialism will ever work - in Heaven where it isn’t needed and in Hell where it’s already in practice!” - Churchill (allegedly)

Utopia is a lovely thought.

But, I’m hopeful today’s youth will grow up, get married, have kids and realize socialism is a pipe dream.

You can’t vote your way to prosperity.

But I get it. The “promise” of a college degree landing you a high paying career and a home with a white picket fence isn’t panning out for a huge percentage of the population.

And they’re not happy about it.

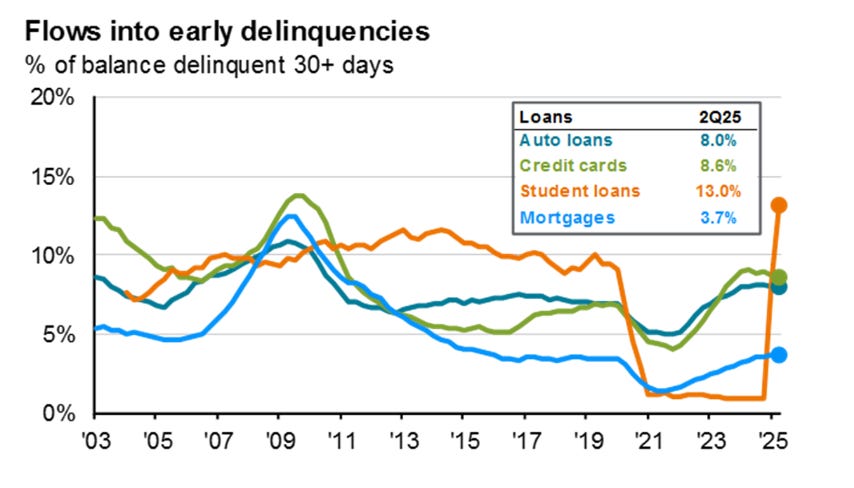

The restart on student loan payments is probably adding fuel to that fire.

Politics is a nasty business best ignored most of the time.

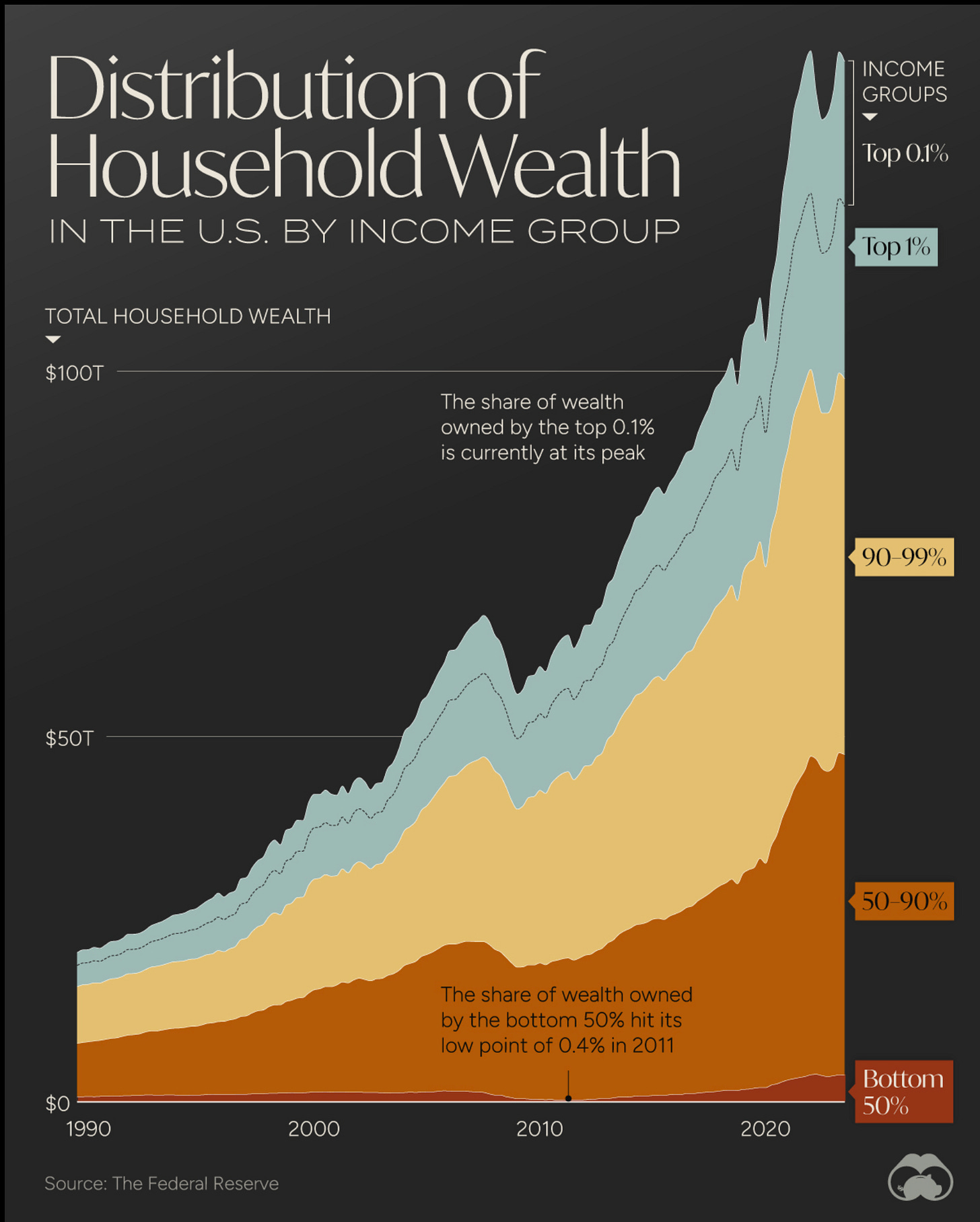

But professional investors don’t get to dismiss the widening gap between the ownership class and the labor class.

Because this is a slow-motion train wreck.

Owners have largely sidestepped rampant inflation thanks to booming financial markets. The “wealth-effect” is powerful. It’s a lot easier to stroke that big vacation check when your net worth keeps climbing.

But as the wealth gap and fiscal deficit widens, the political response is following a predictable (and brutally effective) script: promise more free stuff!

More spending.

More redistribution.

Higher state taxes (at least on the coasts).

And more creative ways to paper over the imbalance.

Just as you can’t vote your way to prosperity, you can’t print your way either.

And yet, every political party seems comfortable with both.

It’s just taxation by another name.

Conclusion

Local politics are weird - especially in large cities - so I don’t want to place too much importance on recent headlines, including New York’s mayoral election.

My guess? The story fizzles in a few years with a new moderate Mayor just like San Francisco’s flirtation with outright socialism.

It situations like this it pays to remember: America remains undefeated.

However, if your mission is to deliver after-tax alpha over decades, you still log the data point.

It’s a reminder that the people voting for “free stuff” don’t own anything - and ownership is increasingly the only way to win in the modern economy.

Because Politicians preaching discipline, austerity, or self-reliance don’t get elected.

So while artificial intelligence remains the wild card, the current path is clear:

Persistent inflation (in the headline numbers or just in the services you care about…like health insurance).

Growing pressure from city and state politicians to raise taxes on high earners.

Tax rates should obviously stay flat in more business-friendly states and under current Washington leadership, but excessive spending and money printing still function as a stealth tax on anyone earning ordinary income or holding dollars instead of productive assets.

Monetary debasement isn’t a tail risk; it’s policy.

What are investors to do about this?

Accumulate more tax-efficient ownership and investments. That’s what the government wants and incentivizes, so lean into it.

Whatever comes, the antidote to excessive inflation and taxation is simple: own scarce, high-quality assets that work when you don’t.

Best,

Brad Johnson

info@evergreencap.com