The CIO Brief: Don’t Time. Trim.

People want things to be binary, but life is a spectrum.

Investing would be simple if we could just rotate back and forth from 100% exposure to 0% exposure. All-in when values are cheap, all-out when things get expensive.

Unfortunately, that is an impossible way to invest. Nobody can time the market with any real consistency. Even if they could, the ongoing capital gains taxes would erode much of the benefit.

But…if you were dead set on trying.

I think you’d have a decent argument to dump your stocks and head to the beach.

Ok, so the market is rich.

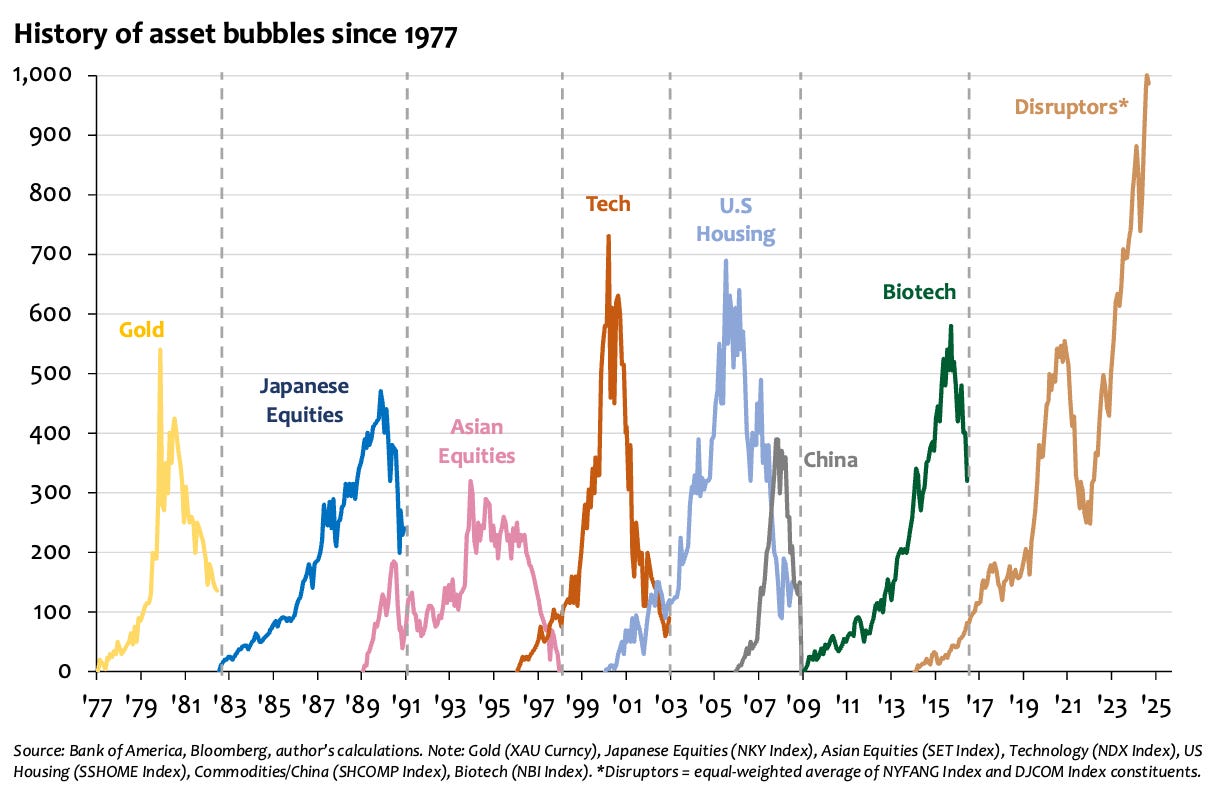

Does that mean bubble go pop?

Nope. The market is maddening in this way. Markets can stay expensive for years. Or longer.

Maybe this time is different.

Maybe this is a new paradigm.

Maybe these are dangerous words and these firms are grossly overspending on AI infrastructure? Who knows.

What we do know is most of the Mag 7 are far better businesses than the average S&P holding over the last 100 years. Plus, today’s valuations are being supported the constant bid from passive ETF flows (that could care less what valuations are).

In other words, irrational and unstoppable are two entirely different things.

However, if your portfolio is 100% the S&P, you are very long and very correlated to just a handful of mega tech firms.

So what’s the alternative?

You can white knuckle the volatility and hope the music keeps playing.

You can can ping-pong between total exposure and zero exposure.

Thankfully, there is a 3rd option. You don’t have to sell everything.

You don’t even have to guess if the market is expensive.

You can just trim.

If your target allocation is 60 percent stocks and it drifted to 80 percent, that extra twenty percent is no longer a reward for being right. It’s concentration risk well outside of your investment plan.

Rebalancing is what endowments and the largest family offices do. They don’t chase heat. They harvest it.

And while the US looks expensive, other pieces of the puzzle are not. Small caps are priced near recession territory and real assets including real estate, infrastructure are among the only areas that screen cheap on a relative basis.

We’re not trying to make a heroic call on small caps. The point is simple. You don’t want a portfolio that only works if US large caps stay hot.

Rebalancing doesn’t mean selling stocks and sitting in cash. It means redirecting gains into areas that are actually priced for forward returns rather than past performance. That’s what professional allocators have done for decades while the rest of the market piles into the same handful of mega cap names.

That doesn’t require a prediction. It just requires acknowledging that the next decade may look different than the last. If your entire plan depends on the same winners repeating their last decade of returns, you’re not diversified.

So instead of timing, we trim. Instead of predicting, we process.

That is how you stay invested without being reckless. That is how you compound without pretending you have a crystal ball.

Best,

Brad

PS - If your stock exposure has drifted way above target or you feel stuck because of embedded gains, reach out. We can walk through options that manage taxes and rebalance to a diversified portfolio.

Click here to schedule a strategy call.