Real Estate Investing Sins

Plus Germans Hate Landlords | Carried Interest Loophole

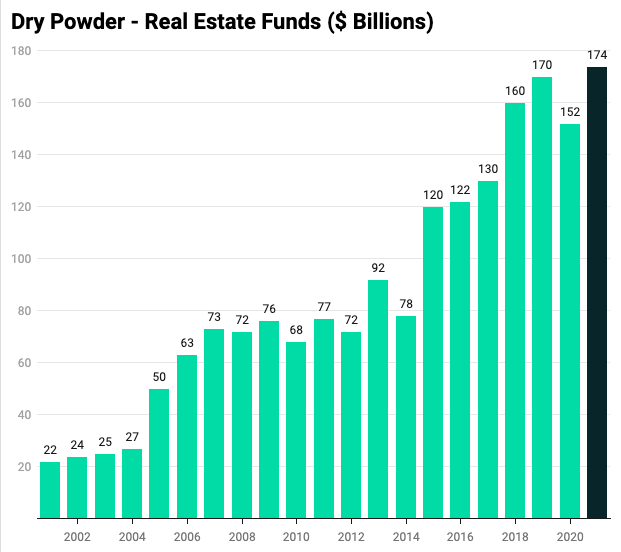

PE firms are raising breathtakingly large real estate funds.

Brookfield is seeking $15B for its latest RE fund and Blackstone is seeing record inflows. Carlyle and Lone Star have recently closed funds in the $5-$10B range. These firms are tripping over themselves to land large portfolios and deploy capital. Transaction volume is up and competition is rising.

These firms don’t get paid for sitting on cash and last year was a slow transaction year thanks to covid. This bodes well for real estate values over the near term.

This same dynamic is also playing out amongst much smaller real estate investment firms.

Given this, I thought it’d be a good time to go over the naughty list of real estate acquisition tactics. Reason being: the increased competition is going to tempt some investors into critical mistakes thanks to animal spirits and short-term thinking.

Repeat after me. Real estate investors shall not commit the follow:

Sin 1 - Goosing The Numbers

It’s your 10th time coming in 5th place in a bidding war and you’re sick and tired of losing. You really want this next one, but you’re having a hard time getting to the broker’s whisper number…again. Why not just bump up that yearly rent increase assumption or juice that exit value a couple million? Come on, clearly everyone else is doing it, why not you? Plus — if you squint real hard — the numbers still work.

Just one keystroke and they’ll award you the deal in this 3rd “best and final” round (but who's counting).

You didn’t come here to do the dishes; you came to win.

But here’s the thing. Maintaining discipline and spinning your wheels chasing deals is actually not the bad outcome. It just feels like losing because you put in effort and nothing tangible happened.

“Winning” an overpriced deal that results in little or even negative profit over a five plus years of your life - now that is a bad outcome. That is losing.

Sin 2 - Going Short on Term

This is not the time to do a 1 year bridge loan to implement a value-add strategy. If the lender will only offer 2-3 years, try to get two one year extensions if the property meets certain performance thresholds. If bridge debt is the only viable solution (often the case for turnaround deals) fight hard for extra time.

Personally, at this stage in the cycle I would trade a higher interest rate for an additional year or two of term. Do whatever you can to avoid forced selling, which is usually due to unlucky downturn timing. That might include:

working on refinancings early when capital markets are flush

staggering your loan expirations

getting a bank to offer you a rainy day credit facility

building more capital relationships now while times are good

Real estate works incredibly well over long time periods. You just have to survive the temporary downturns.

Just like the stock market - if you stay in the game; eventually you win.

Sin 3 - Cross Collateralizing Debt

Just don’t do it. It’s so tempting to put everything under one loan. It simplifies things and lowers your blended interest rate and increases debt proceeds. That’s all fine and dandy, but this also A) hides deal problems, allowing owners to push leverage on marginal deals and B) dramatically increases overall portfolio risk. If one deal tanks, things get messy and you could lose your shirt.

This is especially true if you have a sharky lender that has aggressive loan covenants.

If you really want debt at the portfolio level / operating company, get sufficient scale and pursue unsecured debt for the business. This is easier said than done when you’re small but some balance sheet lenders will get creative and might give you an unsecured loan sooner than you think.

Sin 4 - Overleveraging

Pretty self explanatory. It’s tempting to add mezzanine debt to reach 85-95% loan to values in order to stretch on price to win a deal. There is a reason the best debt funds generate equity like returns with debt like risk; their business model is boosted by ‘loan to own’ deals. They are actively rooting for some deals to default so they can take back the keys. Don’t over-leverage and fund their new jet.

Sin 5 - Ignoring Capital Expenses

An easy way to push the numbers to win a deal is to conveniently overlook the old roof, deteriorating walls or failing HVAC system. Early in the cycle it’s easier to ignore non-essential property improvements as the multiple expansion (cap rate compression) is probably going make up the bulk of your return.

Mid to late cycle - it’s important to reserve funds for capital expenses. Without as much structural appreciation to bail you out in a sale, you have to win through operations. It’s hard to push occupancy and rents if the building is falling apart.

If you’re buying a $10M deal and your capital reserve budget is $10K, confess your sins and raise a capital buffer.

Purgatory - Floating Rate Debt

All bets are off with interest rates. If you’re comfortable going with a floater, go for it. When I was exclusively an operator, I left a fair amount of money on the table using safer, fixed rate debt. But I prefer to sleep well at night and avoid blow up risk vs. trying to squeeze every penny out of a deal.

Proponents of floating debt argue that their refinance risk is not actually that high. If rates are rising, they believe their rents and operating income (to cover higher debt payments) will rise as well. As I highlighted in the last memo Rising Rates & Real Estate - they have a point (at least in most rising rate environments). Key here is to have time or flexibility with your lender. You need time to let the rents catch up with rates.

A viable compromise (fixed vs. floating debt) is to either A) use floating debt on only your lower leveraged deals or B) pay up a bit for interest rate caps or hedges; just in case.

Salvation

Losing a deal that someone overpaid for is not fun, but the alternative is worse.

Focus on your long-term investing goals. If you can’t help yourself and decide to push values a bit, at least do it in growing markets and don’t compound the error by trying to make up returns with excessive debt terms.

Take a lesson from the REITs on this point.

One of the many things we like about REITs is they almost never commit the above transgressions. They use conservative / debt (35%-40% LTV on average) that is either isolated at each asset or unsecured. This keeps them in the game, lets them focus on growth and add leverage if needed.

Case in point: thanks to their conservative balance sheet, AvalonBay just completed a public offering of $700M of unsecured 2.050% notes that they raised in hours (vs. a 90 day mortgage process). I’m jealous.

Those of us that can’t tap ~three quarters of a billion in a couple days will have to be a bit more thoughtful about financing is this environment.

Evergreen Real Income Fund

The fund’s purpose is to deliver world-class income yields and it’s achieving that goal.

You can learn more about the Evergreen Real Income Fund by clicking on the link below.

Market Highlights

It’s Time To Build - Institutions excel at fighting the last war. This point should hit home every time you take off your shoes at the airport. Not to be outdone by the TSA, homebuilders and lenders puckered up the last decade, desperately trying to not repeat their subprime crisis mistakes. They overcorrected. Some 12.3 million American households were formed from January 2012 to June 2021, but only 7 million new single-family homes were built during that time.

Ze Germans Are Coming…for Apartment Owners?? In scary landlord news, voters in Germany - who are apparently fed up with rising rents - will vote whether to expropriate (cough: steal) the portfolios of any German apartment owner that has 3,000+ units. While the vote might actually pass, it’s highly unlikely to implemented. However, it will be interesting to see if this referendum leads to tighter regulation of residential landlords in Europe.

PropTech Heat Check - real estate tech startup Pacaso raised a $125M series C to “help people co-own a second home”. Sounds like they invented…a timeshare. We kid, best of luck to them. The round was lead by (checks notes) SoftBank. Ah ha, I get it now.

Carried Interest Carries On - well, at least it always seems that way. Increasing taxes on private equity profits is debated in Washington every year. Yet they remain taxed at cap gains rates. Given the President’s $3.5 trillion budget and the democrat majority, one would assume this favorable tax treatment is toast. We won’t be surprised either way.