GP Stakes Investing - Deep Dive

Minority ownership in private equity general partnerships

“My God, it is good to be a general partner.

It’s truly a tails I win, heads you lose proposition.”

- Hamilton Lane (~$1 Trillion Asset Manager)

What makes GP Stakes investing so compelling:

Bond-like cash flow with equity optionality.

GP stakes combines the durable income of bonds with the upside potential of equity via direct ownership of private equity firms.

A Better Way to Invest in Private Equity

You get a seat at the table of legendary private equity firms without having to fly to New York for the board meetings or do any of the hard work to generate their top-tier returns.

You don’t have to visit Omaha for a steak dinner with the 80 year old owner of a manufacturing business hoping you can talk him into selling. No all nighters working on an Excel financial model for tomorrow’s stressful investment committee meeting.

A GP Stakes investor leapfrogs that brutal work and jumps straight into senior partnership. It’s effectively a do nothing ownership role typically reserved for the grey-haired, bushy eyebrowed founding Chairman that just collect checks.

Or if you need a metaphor, pretend that Taylor Swift offered to let you buy 20% ownership of:

her label

her entire music catalogue

her brand and all intellectual property…

…and you get to pay her a below market multiple on actual cash flow.

As a minority partner in “Taylor Swift LP”, you’d get 20% of all her song royalties, concert ticket sales, merch sales, book sales, corporate partnerships.

Everything she makes, you get your share.

And you collect those checks from here until eternity.

In other words, a growing cash machine that should perform in both boom and bust times (i.e. low correlation to stock market).

Would you ever sell that?!

Or would you just collect larger and larger checks until you gifted the ownership to your kids and grandkids at a stepped up tax basis?

In our view, that’s GP Stakes.

Cool Metaphor ‘Swiftie’, What Exactly is it Though?

GP stakes investing involves acquiring minority ownership stakes (typically 20% or less) in institutional-quality private equity, private credit and real estate investment firms.

These are non-controlling interests in some of the most respected money-making machines on Wall Street. Many are proven brand names like Silverlake, Vista Equity and Starwood Capital.

The magic? You're buying a discounted minority stake in the PE firm itself, not just a single fund.

You’re not an investor or limited partner. GP Stake investors become a non-voting owner (with protection rights) on day one.

This means you're collecting your pro rata share of all management fees, performance fees, and any appreciation in value from the firm's growth.

Why Do General Partnerships Sell Stakes?

If these businesses are so great, why would GPs ever sell a single share?!

There are three primary motivations for private equity firms to sell stakes:

Growth Capital: As funds expand, managers require capital to fund operational growth and meet increasing fund co-investment requirements. They have to invest in each of their funds. Despite their substantial success, 3% on a $10 billion fund ($300 million) is still a lot of money for these partners. Needless to say, most partners don’t have that lying around, especially if they just had to pony up $200M three years ago for a prior fund.

Strategic Expansion: Firms seek resources to penetrate new geographies or asset classes (ex: a new debt fund), demanding significant investments in talent and infrastructure.

Generational Transition: With many private equity pioneers now in their eighth decade, GP stakes sales enable leadership succession. In other words, they need a capital-infusion to cash the old guys out.

If their firms were publicly traded this would be easy, but since they are private this usually requires outside capital. The younger partners have most of their wealth tied up in the firm as well.

Revenue Streams in GP Stakes Investments

GP stakes benefit from four primary revenue streams:

Management Fee Revenue: The most predictable and stable income source in a private equity business

Carried Interest: Performance-based fees that can be substantial but are more sporadic based on the sale of the firm’s underlying investments.

Balance Sheet Returns: Profits from the GP's own co-investments in their funds (the profits on the $300 million investment in the previous example).

Enterprise Value Growth: Appreciation from growth in assets under management “AUM” or multiple expansion (realized in a refinancing, IPO or sale to another asset management firm).

The most important of these four streams is management fee revenue as those fees provide significant downside protection.

This is a structural advantage - when a private equity firm closes a 10-year fund, its fees are contractually set in stone, providing a durable cash flow stream backed by some of the world's most sophisticated institutional investors (large pension funds, sovereign wealth funds and endowments).

Provided a target firm is successful in raising just one more flagship fund at roughly the same size or larger to the prior fund, the GP Stakes investor should get most of their capital back on contractual management fees alone.

Even if they don’t raise another penny, fees from existing funds should still return upwards of 80% of the invested capital (in an unlikely PE firm liquidation scenario).

Asymmetric Return Profile

Typical target return profile:

Target equity multiple: 3.0x - 3.5x

Cash flow returns similar to private credit investments along the way

Potential for multiple expansion on exit

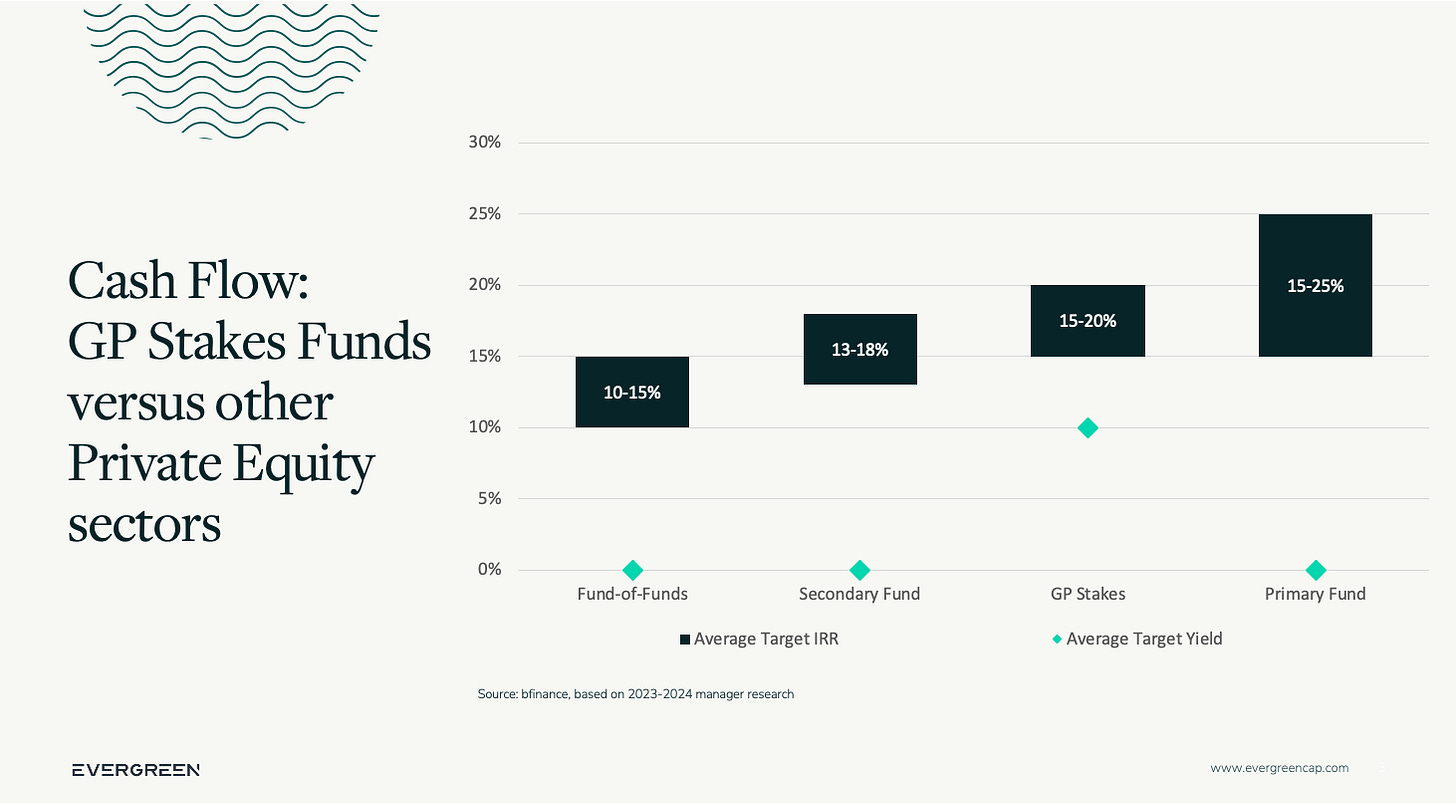

Long Term Returns

Assuming economic theory holds, given their extreme diversification and much lower risk profile vs. individual PE Funds GP Stake investments should warrant a lower return vs. less diversified investments.

That’s not the case today, as we believe 20%+ returns are still within reach this cycle (~the next 10 years). However we believe the longer term returns will likely stabilize in the range detailed on the chart below vs. other segments of private equity.

Diversification Across Managers & Fund Vintage Years

Each GP Stake investment gives you exposure to all the PE firm’s underlying funds. Therefore a portfolio of 50 GP ownership investments is likely to give you access to hundreds of individual private equity funds.

Investor Efficiency

Not only is GP Stakes the most diversified way to access the world of private equity, it’s also the most efficient way to put that capital to work in PE.

Given you’re buying into the Partnership, a GP Stakes investor might have their capital invested in that great business their entire life. When you can find great assets that compound cash flow, a buy and hold strategy is how you achieve life changing outcomes, vs. having to trade in and out of various funds.

Investing in a series of private equity funds and recycling capital frequently creates all kinds of problems for non-institutional (retail) investors. They have to keep track of too many capital calls and end up holding excess funds in cash to meet those future commitments (thus dampening return performance).

In private markets, staying fully invested is the best way to compound returns.

See the chart below. For a given evergreen fund’s return (top row), the required equivalent return on a traditional closed-end fund to reach the same dollar-on-dollar multiple is shown in the bottom row.1

Closed-end fund refers to a traditional commingled private equity fund that calls it’s capital over time (often less than 100% called) and liquidates in 10 years.

At the risk of beating this horse to death… if you’re a minority owner of a portfolio of private equity firms, (historically money printing machines) why would you ever want to sell? This is especially true when you’re receiving high and growing monthly distributions.

This makes GP Stakes investing ideal for high net worth investors without their own family office staff to deal with this issue or the drag on investment returns for keeping for already committed funds idle in cash.

Evaluating GP Stakes Investments

So, how do you compare various GP investment opportunities?

1. Limited Partner Stability

The quality of a firm's limited partner (LP) base is critical. GP Stake investors must analyze:

LP turnover & re-investment rates (a good sign the investors are happy)

The caliber of institutional investors in each fund

The potential for geographic or strategy expansion

The track record of (ideally) increasing fund sizes

This process is about gauging the firm’s ability to consistently grow assets under management and thus a GP Stakes investor’s cash distributions.

A PE firm might have a great track record, but if they can't scale their funds from $1 billion to $5 billion over time, they’re constrained and not an attractive long-term GP Stakes investment.

2. Team Quality and Succession Planning

Like any business, it’s about the people. Assessing the quality of the management team and their plans for leadership succession can’t be overlooked, especially for firms founded several decades ago.

Is it clear the younger partners have played a critical role in sourcing and running each investment? This is less of a risk than a hedge fund where the track record can literally hinge on one person, but it’s still critical to evaluate the “bench talent”, aka which individuals are in-line to run the private equity firm over the next 10-20 years.

3. Valuation

You can always spoil a great business by dramatically overpaying. Therefore GP Stake investors need to evaluate each entry valuation relative to peer firms and the potential for multiple expansion. Thankfully, most GP Stakes trade at a large discount to public market comps (i.e. Blackstone, KKR, Apollo). The metric typically used for this is price to distributable earnings, or the cash flow the business generates.

The Broader Context: Why Private Equity?

Private equity has consistently outperformed public market indices, offering:

Substantially higher historical returns

Access to a much larger universe of companies (80%+ of large $100M+ EBITDA companies are private)

With far lower market volatility

All Private Equity 10-Year Rolling Returns:

Private equity has regularly outperformed public indices over almost every 10-year period, which aligns with typical private equity investment horizons.

Investor Implications

The data is clear that private equity boosts portfolio returns across cycles.

Historically, "now" has consistently been a great time to invest money in private equity, regardless of the entry point over the past 25 years. The elite firms have delivered great long-term results under various market dynamics, in both rising and declining interest rate environments.

Alternative Assets Growth

According to Preqin, private assets have seen substantial growth, which is likely to continue for the foreseeable future. This bodes well for GP Stake investments.

Why are private markets growing so quickly?

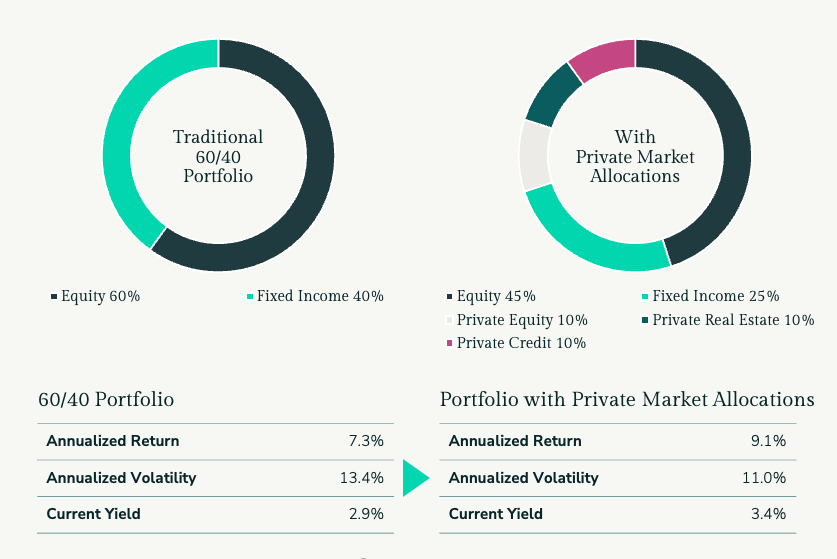

Allocators Love Private Markets

Adding private assets to investor portfolios improves overall return performance vs. a traditional 60%/40% (stock/bond) portfolio.

So returns have been higher, yet volatility has been lower.

That should be the opposite, which is why investors continue to grow their allocation to alternative assets.

And finally, there are 7x more private companies (over $100 million in revenue) than publicly traded companies. It’s easier to generate alpha when you’re not restricting the size of your market.

Conclusion

GP stakes investing represents a unique opportunity to participate in the economics of world-class investment firms (private equity, credit and real estate), historically offering investors durable cash flows, capital appreciation, and significant downside protection.