Avoiding Falling Knives

Plus the Advantages of Discounted vs. Distressed Investing

I used to think technical analysis of stock charts was 100% nonsense voodoo.

Now I think it's only 80% bullshit.

Because some of the greatest investors in the world (ex: Druckenmiller, Bill Miller) use it in their process to avoid "falling knives".

The chart helps them decide when to start buying discounted assets while avoiding a further free fall in price.

What do you call a stock down 90%?

A stock that was down 80% that then got cut in half.

Such investors are content to miss bottom-of-the-barrel pricing by waiting for prices to stabilize and start ticking upwards.

Before they pull the trigger, they want to see "signs of life".

Given that animal spirits, investor confidence and debt markets drive P/E multiples and cap rates, this element of the investment process shouldn't be dismissed outright.

Because “narrative” drives price over the short term.

All of this is difficult for a cash flow investor to admit. But completely dismissing the human element of investing in favor of pure math is outdated.

Plus it rarely pays to be dogmatic in markets. Market dynamics change.

Otherwise you run the risk of becoming the value investing purists that only invest in super cheap stocks well below book value. A metric that is now completely meaningless for most asset-light, technology companies.

Many of these poor souls completely missed the unreal returns in most asset classes the last 14 years. They were waiting for deep distress vs. discounts (stemming from temporary setbacks or the market underestimating future cash flow growth).

There are orders of magnitude more opportunities to buy such great, discounted assets vs. deeply distressed assets that will one day become great.

Personally, I'd much rather feed my family fishing for tuna than Moby Dick.

That being said, the deep value investors will likely end up being right about today’s Magnificent 7 valuations (which appear frothy as of 11.26.24). But even so - given the record gains for mega tech the last decade - such investors will have won the battle but lost the war while they were waiting for “blood in the streets”.

The Distress That Never Came

Firms dedicated to distressed investing can deliver great returns, but they are sporadic. This is a god awful way to build an investment business.

Case in point, not only are the opportunities few but sometimes the distress is a mirage. Countless distress focused real estate funds raised since COVID will likely end up returning most of their capital to investors. That’s not fun.

Distress investing is also one of the hardest ways to consistently compound capital. Reason being, once the price corrects and the asset hits full value, you have to sell to adhere to the strategy.

That means to be a focused distress investor you have to:

constantly find new distressed investments to replace the ones that worked (no flywheel advantages).

use prior profits to float payroll and operations during bull market runs where the firm has to “sit on its hands” and can’t deploy capital.

overcompensate for tax drag (ordinary income or cap gains) vs. letting evergreen investments compound “friction free”.

I get it though. The siren song of fire sale prices calls us all. Who doesn’t love a smoking hot deal?

However, we still prefer the less sexy strategy of investing in great assets that stack cash flow year in and year out at high returns on invested capital (aka the “quality investing” investment style).

These high-quality assets are potential forever holds as the consistent cash flow growth gives you the confidence to hold through broader market volatility. The problem is, such assets almost never fire sale.

Which is why none of our GP Stake investments are with general partners that focus exclusively on distress funds.

Some of our GPs might raise the occasional special situation distress fund, but that’s a small part of their main investment business. We prefer general partners whose flagship funds reliably “make contact” on every at bat, delivering doubles and triples over home run specialists that go long stretches with zero production.

When To Buy Discounted CRE?

But back to knife catching….

Waiting for an uptick in price tends to be an even more reliable buy signal in commercial real estate vs. the stock market - especially given the former's glacial transaction pace the last few years.

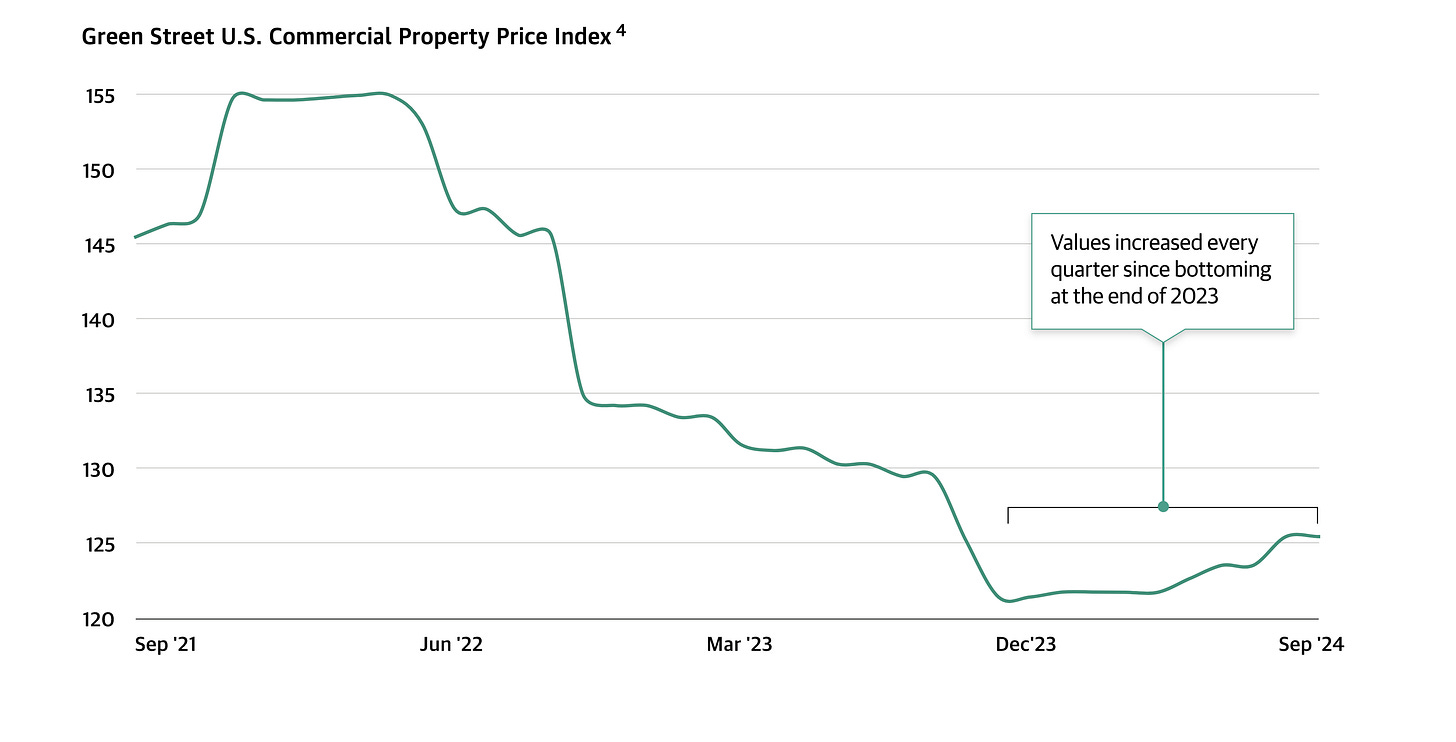

Case in point - the chart below suggests the pain for CRE is in the rearview.

We talk to a lot of operators who could have spent the last three years on the beach vs. banging their heads against the wall trying to do deals.

However, today they’re all starting to find a few opportunities that make sense and not one of them is pessimistic about the next five years.

That is not a recipe for distress investing. You need despondency for distress.

There remains a wall of capital ready and willing to transact for deals that can support reasonable leverage. Therefore, excluding office buildings, there are only discounted opportunities (vs. peak pricing); there are very few distressed opportunities.

This herd mentality / consensus confidence is often a sell sign in public markets, but in private markets renewed animal spirits is good for business at this stage in the real estate cycle.

Uncertainty (especially from lenders) sucks liquidity out of the market and tanks pricing whereas “good vibes” boosts liquidity and tends to create a floor on valuations.

“Good vibes” sounds stupid as an investment consideration, but I don’t make the rules.

So while the courageous firms buying real estate a year ago likely “bottom ticked” the market on price, those investing today might be taking far less "risk" of actual capital loss.

As ex-post, nobody knows how high inflation and interest rates might have gone.

In other words, was the distressed buy decision smart or lucky? How many times out of 100 would the investment worked out?

Not to get weird, but you don’t know because you obviously can’t see those alternative realities….unless you’re into psychedelics, in which case perhaps you think you do. If so I’m happy for you, but please don’t share your magical visions with me and no I don’t want to do an ayahuasca idea session with you.

Anyways, most distressed buying opportunities seem obvious after the fact, but they never do in the moment. Therefore, I deeply respect those able to consistently venture out into the fray, not knowing what’s on the other side.

I’m good at finding that courage in spots - namely when something is dirt cheap in my direct circle of competence (e.g. asset management firms, niche real estate, Chipotle burritos, etc.)

However, I generally prefer the fog start to clear to see if the intrepid distressed investors are still standing.

Best,

Brad Johnson